Structural reform

This chapter presents the latest assessment of transition challenges in the EBRD regions, looking at whether economies are competitive, well governed, green, inclusive, resilient and integrated. It also provides, for the first time, an assessment of six comparator economies in sub-Saharan Africa (SSA): Benin, Côte d’Ivoire, Ghana, Kenya, Nigeria and Senegal. Their scores tend to be lower than those of EBRD economies, in line with their lower levels of income per capita. The largest gap between the two is in the area of integration, with a smaller gap in the area of inclusion. Since 2016, SSA economies have seen marked improvements in competitiveness and resilience, while little progress has been made in terms of integration.

Introduction

This chapter presents the latest assessment of transition challenges in the EBRD regions, tracking progress in the area of structural reform. It focuses on six key qualities of a sustainable market economy, looking at whether economies are competitive, well governed, green, inclusive, resilient and integrated. For each quality, progress is assessed on a scale of 1 to 10, where 1 denotes the worst possible performance and 10 corresponds to the standards of a sustainable market economy. Those “assessment of transition qualities” (ATQ) scores are based on a wide range of external and internal data sources and calculated in accordance with a detailed methodology (see Table 5.1).1

| Competitive | Well governed | Green | Inclusive | Resilient | Integrated | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | |

| Central Europe and the Baltic states (CEB) | ||||||||||||||||||

| Croatia | 5.84 | 5.81 | 5.85 | 6.51 | 6.19 | 6.32 | 6.91 | 6.90 | 6.01 | 6.88 | 6.83 | 6.93 | 6.73 | 6.73 | 6.01 | 6.67 | 6.65 | 6.27 |

| Czechia | 6.43 | 6.42 | 6.50 | 7.55 | 7.50 | 7.08 | 7.15 | 7.18 | 6.59 | 7.10 | 7.09 | 6.98 | 7.50 | 7.52 | 7.58 | 7.63 | 7.58 | 7.93 |

| Estonia | 7.59 | 7.59 | 7.24 | 8.83 | 8.82 | 8.59 | 7.17 | 7.08 | 6.22 | 7.79 | 7.76 | 7.33 | 7.53 | 7.54 | 7.44 | 7.72 | 7.68 | 7.57 |

| Hungary | 6.08 | 6.07 | 5.98 | 6.04 | 6.02 | 5.89 | 6.86 | 6.83 | 6.14 | 6.28 | 6.29 | 6.19 | 7.02 | 7.01 | 6.76 | 7.46 | 7.33 | 7.15 |

| Latvia | 6.12 | 6.10 | 6.04 | 7.57 | 7.55 | 6.93 | 7.10 | 7.11 | 6.31 | 7.19 | 7.19 | 6.79 | 7.15 | 7.18 | 6.96 | 7.46 | 7.38 | 7.28 |

| Lithuania | 6.44 | 6.41 | 6.31 | 7.93 | 7.96 | 7.36 | 7.14 | 7.17 | 6.53 | 7.33 | 7.26 | 7.07 | 7.27 | 7.27 | 6.89 | 7.66 | 7.59 | 6.98 |

| Poland | 6.28 | 6.27 | 6.27 | 6.85 | 6.85 | 7.46 | 7.05 | 7.05 | 6.53 | 7.13 | 7.08 | 7.00 | 7.49 | 7.49 | 7.31 | 7.13 | 7.02 | 6.75 |

| Slovak Republic | 6.28 | 6.27 | 6.17 | 6.63 | 6.62 | 6.32 | 7.20 | 7.27 | 6.75 | 6.81 | 6.82 | 6.64 | 7.64 | 7.63 | 7.50 | 7.26 | 7.33 | 7.29 |

| Slovenia | 6.28 | 6.26 | 6.33 | 7.27 | 7.26 | 7.28 | 7.31 | 7.29 | 6.70 | 7.64 | 7.55 | 7.28 | 7.45 | 7.41 | 7.18 | 7.40 | 7.32 | 6.72 |

| South-eastern Europe (SEE) | ||||||||||||||||||

| Albania | 4.95 | 4.93 | 4.79 | 4.88 | 4.87 | 5.43 | 4.89 | 4.89 | 4.86 | 5.54 | 5.59 | 5.06 | 4.65 | 4.61 | 4.35 | 5.51 | 5.50 | 5.41 |

| Bosnia and Herzegovina | 4.62 | 4.60 | 4.56 | 4.24 | 4.25 | 4.84 | 5.38 | 5.32 | 4.74 | 5.65 | 5.68 | 5.46 | 4.86 | 4.83 | 4.69 | 5.19 | 5.22 | 4.72 |

| Bulgaria | 5.51 | 5.49 | 5.41 | 6.08 | 6.03 | 5.97 | 6.67 | 6.59 | 5.55 | 6.19 | 6.17 | 5.86 | 6.10 | 6.06 | 5.81 | 6.70 | 6.65 | 6.75 |

| Greece | 5.50 | 5.50 | 5.84 | 6.05 | 6.06 | 5.84 | 6.72 | 6.74 | 6.00 | 6.99 | 6.96 | 6.74 | 7.21 | 7.16 | 6.85 | 7.08 | 7.10 | 5.90 |

| Kosovo | 5.30 | 5.28 | 4.91 | 4.95 | 4.99 | 5.09 | 3.72 | 3.71 | 3.56 | 5.58 | 5.50 | 5.43 | 4.59 | 4.56 | 4.10 | 6.51 | 6.43 | 6.01 |

| Montenegro | 5.45 | 5.43 | 5.17 | 6.49 | 6.45 | 6.06 | 6.21 | 6.20 | 5.48 | 5.95 | 5.93 | 5.55 | 5.39 | 5.35 | 4.96 | 5.81 | 5.79 | 5.30 |

| North Macedonia | 5.09 | 5.09 | 4.85 | 5.59 | 5.56 | 5.92 | 5.67 | 5.68 | 4.83 | 5.65 | 5.57 | 5.38 | 5.26 | 5.25 | 4.77 | 6.39 | 6.36 | 5.52 |

| Romania | 6.11 | 6.08 | 5.73 | 6.31 | 6.32 | 6.12 | 6.70 | 6.64 | 5.97 | 6.08 | 6.07 | 6.01 | 6.66 | 6.66 | 6.23 | 6.71 | 6.67 | 6.42 |

| Serbia | 5.29 | 5.28 | 5.10 | 6.08 | 6.11 | 5.86 | 5.51 | 5.52 | 4.99 | 5.99 | 5.98 | 5.68 | 5.19 | 5.17 | 5.04 | 6.59 | 6.55 | 5.87 |

| Türkiye | 5.64 | 5.62 | 5.64 | 6.15 | 6.22 | 6.13 | 5.39 | 5.38 | 4.95 | 5.42 | 5.41 | 5.36 | 6.61 | 6.66 | 6.40 | 6.10 | 5.99 | 5.99 |

| Eastern Europe and the Caucasus (EEC) | ||||||||||||||||||

| Armenia | 4.41 | 4.38 | 4.08 | 6.52 | 6.39 | 5.97 | 5.73 | 5.71 | 5.4 | 5.23 | 5.20 | 4.98 | 5.61 | 5.61 | 4.90 | 5.67 | 5.61 | 5.16 |

| Azerbaijan | 3.99 | 3.98 | 4.03 | 5.68 | 5.74 | 5.36 | 5.04 | 5.01 | 4.72 | 5.65 | 5.60 | 5.46 | 3.30 | 3.24 | 3.27 | 5.18 | 5.15 | 5.53 |

| Georgia | 4.88 | 4.84 | 4.53 | 6.32 | 6.39 | 6.58 | 5.51 | 5.48 | 5.03 | 5.50 | 5.50 | 5.28 | 5.55 | 5.56 | 4.50 | 6.52 | 6.57 | 5.80 |

| Moldova | 4.58 | 4.57 | 4.43 | 5.23 | 5.19 | 4.70 | 4.70 | 4.71 | 4.33 | 5.77 | 5.69 | 5.56 | 4.70 | 4.76 | 4.36 | 5.15 | 5.22 | 5.17 |

| Ukraine | 4.72 | 4.72 | 4.85 | 4.52 | 4.48 | 4.30 | 5.46 | 5.44 | 5.08 | 5.90 | 5.92 | 5.63 | 4.54 | 4.51 | 3.74 | 5.24 | 5.31 | 5.29 |

| Central Asia | ||||||||||||||||||

| Kazakhstan | 4.87 | 4.85 | 4.71 | 6.33 | 6.32 | 5.77 | 5.07 | 5.09 | 4.67 | 5.63 | 5.59 | 5.27 | 5.46 | 5.42 | 5.01 | 5.22 | 5.24 | 4.91 |

| Kyrgyz Republic | 3.78 | 3.78 | 3.64 | 4.36 | 4.46 | 4.44 | 4.87 | 4.86 | 4.49 | 4.93 | 4.94 | 4.79 | 4.22 | 4.20 | 4.18 | 4.53 | 4.57 | 4.20 |

| Mongolia | 3.91 | 3.90 | 4.23 | 5.33 | 5.00 | 5.48 | 4.64 | 4.68 | 4.76 | 5.65 | 5.66 | 5.23 | 4.54 | 4.54 | 4.22 | 5.18 | 5.28 | 4.74 |

| Tajikistan | 3.34 | 3.33 | 3.24 | 4.66 | 4.74 | 4.31 | 5.41 | 5.40 | 5.14 | 4.04 | 4.02 | 3.86 | 3.47 | 3.47 | 2.91 | 4.05 | 4.08 | 3.41 |

| Turkmenistan | 3.02 | 3.02 | 3.27 | 2.85 | 2.88 | 3.01 | 4.86 | 4.84 | 4.85 | 4.45 | 4.41 | 4.19 | 3.33 | 3.33 | 3.14 | 4.24 | 4.30 | 4.24 |

| Uzbekistan | 3.77 | 3.76 | 3.50 | 5.00 | 5.02 | 4.79 | 5.42 | 5.40 | 4.91 | 4.78 | 4.67 | 4.39 | 3.76 | 3.76 | 3.4 | 5.25 | 5.19 | 4.37 |

| Southern and eastern Mediterranean (SEMED) | ||||||||||||||||||

| Egypt | 3.54 | 3.53 | 3.52 | 5.57 | 5.58 | 4.95 | 4.98 | 5.08 | 4.53 | 4.33 | 4.30 | 4.28 | 4.63 | 4.61 | 4.29 | 5.66 | 5.58 | 4.70 |

| Jordan | 4.53 | 4.52 | 4.57 | 6.12 | 6.15 | 6.08 | 5.34 | 5.34 | 5.58 | 5.01 | 4.91 | 4.54 | 5.06 | 5.06 | 4.63 | 5.58 | 5.56 | 5.94 |

| Lebanon | 4.30 | 4.29 | 4.57 | 3.63 | 3.65 | 4.11 | 4.79 | 4.80 | 4.94 | 4.29 | 4.30 | 4.65 | 2.95 | 2.95 | 3.89 | 5.19 | 5.09 | 5.13 |

| Morocco | 3.81 | 3.8 | 3.71 | 5.89 | 5.86 | 5.6 | 5.29 | 5.29 | 5.18 | 4.91 | 4.88 | 4.66 | 4.69 | 4.68 | 4.53 | 5.24 | 5.18 | 5.07 |

| Tunisia | 3.91 | 3.91 | 4.13 | 4.88 | 4.90 | 5.25 | 4.79 | 4.82 | 4.65 | 4.96 | 4.98 | 4.86 | 4.00 | 3.98 | 3.63 | 4.89 | 4.93 | 4.70 |

| West Bank and Gaza | 2.56 | 2.56 | 2.35 | 3.60 | 3.61 | 3.52 | 4.13 | 4.14 | 3.96 | 3.87 | 3.88 | 3.88 | 3.68 | 3.68 | 3.50 | 4.59 | 4.61 | 4.16 |

SOURCE: EBRD.

NOTE: Scores are on a scale of 1 to 10, where 10 represents a synthetic frontier corresponding to the standards of a sustainable market economy. All scores have been updated following methodological changes, so they may differ from those published in previous years’ reports. Owing to lags in the availability of underlying data, ATQ scores for 2024 and 2023 may not fully correspond to developments in those calendar years. Exceptionally, Chapter 5 treats Greece as part of the SEE region.

Introducing comparator economies in sub-Saharan Africa

For the first time, the analysis in this chapter also covers six new comparator economies in sub-Saharan Africa: Benin, Côte d’Ivoire, Ghana, Kenya, Nigeria and Senegal (see Table 5.2 and Chart 5.1).

| Competitive | Well governed | Green | Inclusive | Resilient | Integrated | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | 2024 | 2023 | 2016 | |

| Advanced economies | ||||||||||||||||||

| Canada | 7.61 | 7.61 | 7.51 | 8.76 | 8.74 | 9.04 | 7.10 | 7.13 | 6.52 | 8.33 | 8.34 | 8.21 | 8.15 | 8.16 | 8.11 | 7.23 | 7.24 | 7.22 |

| Cyprus | 6.65 | 6.64 | 7.10 | 7.36 | 7.37 | 7.19 | 7.03 | 7.08 | 6.04 | 7.43 | 7.39 | 7.14 | 5.80 | 5.73 | 5.55 | 7.09 | 7.13 | 6.95 |

| France | 7.58 | 7.58 | 7.48 | 8.37 | 8.38 | 8.28 | 7.54 | 7.52 | 7.43 | 8.46 | 8.45 | 8.36 | 8.02 | 8.05 | 7.89 | 7.87 | 7.96 | 7.60 |

| Germany | 7.72 | 7.72 | 7.84 | 8.71 | 8.71 | 9.01 | 7.99 | 7.97 | 7.81 | 8.58 | 8.59 | 8.45 | 7.46 | 7.47 | 7.51 | 8.03 | 7.97 | 7.90 |

| Japan | 7.40 | 7.39 | 7.37 | 8.83 | 8.84 | 8.73 | 7.25 | 7.26 | 7.23 | 8.42 | 8.42 | 8.20 | 8.25 | 8.26 | 8.02 | 7.13 | 7.16 | 7.30 |

| Sweden | 8.44 | 8.45 | 8.09 | 9.12 | 9.13 | 9.33 | 7.89 | 7.91 | 7.69 | 8.77 | 8.75 | 8.65 | 8.10 | 8.11 | 8.01 | 7.75 | 7.70 | 7.77 |

| United Kingdom | 8.45 | 8.44 | 8.50 | 8.71 | 8.73 | 9.15 | 7.47 | 7.45 | 7.25 | 8.36 | 8.38 | 8.43 | 8.06 | 8.09 | 7.89 | 7.61 | 7.54 | 7.66 |

| United States of America | 8.09 | 8.09 | 8.20 | 8.74 | 8.78 | 8.81 | 6.15 | 6.20 | 6.70 | 8.08 | 8.08 | 7.91 | 8.70 | 8.68 | 8.54 | 7.35 | 7.32 | 7.37 |

| Sub-Saharan Africa | ||||||||||||||||||

| Benin | 3.43 | 3.43 | 3.04 | 4.35 | 4.23 | 3.79 | 4.50 | 4.50 | 4.38 | 4.00 | 4.01 | 3.98 | 3.20 | 3.25 | 3.04 | 3.42 | 3.29 | 3.18 |

| Côte d’Ivoire | 3.73 | 3.73 | 3.25 | 3.98 | 3.75 | 3.95 | 4.65 | 4.65 | 4.31 | 4.33 | 4.36 | 3.95 | 3.36 | 3.41 | 3.04 | 3.68 | 3.66 | 3.65 |

| Ghana | 3.47 | 3.47 | 3.23 | 4.80 | 4.57 | 4.62 | 4.56 | 4.56 | 4.46 | 4.42 | 4.41 | 4.41 | 3.81 | 3.90 | 2.99 | 3.23 | 3.24 | 3.39 |

| Kenya | 3.90 | 3.89 | 3.70 | 4.53 | 4.41 | 4.36 | 4.87 | 4.87 | 4.67 | 4.46 | 4.43 | 4.44 | 3.59 | 3.65 | 3.17 | 3.80 | 3.86 | 4.10 |

| Nigeria | 3.46 | 3.46 | 3.37 | 3.24 | 3.15 | 3.48 | 4.13 | 4.13 | 3.78 | 3.95 | 3.96 | 4.04 | 3.74 | 3.74 | 2.97 | 3.21 | 3.25 | 3.46 |

| Senegal | 3.64 | 3.63 | 3.23 | 4.57 | 4.36 | 4.32 | 4.55 | 4.55 | 4.41 | 3.90 | 3.89 | 3.68 | 3.18 | 3.23 | 3.04 | 3.68 | 3.64 | 3.05 |

| Other comparators | ||||||||||||||||||

| Bangladesh | 3.55 | 3.54 | 3.45 | 5.77 | 5.83 | 5.73 | 4.33 | 4.46 | 4.07 | 3.65 | 3.64 | 3.68 | 5.47 | 5.47 | 5.10 | 4.09 | 4.27 | 4.37 |

| Belarus | 4.73 | 4.72 | 4.39 | 4.59 | 4.69 | 4.77 | 5.56 | 5.58 | 5.54 | 5.52 | 5.55 | 5.69 | 3.48 | 3.44 | 3.17 | 6.17 | 6.04 | 5.38 |

| Brazil | 4.67 | 4.67 | 4.50 | 5.98 | 6.04 | 6.04 | 5.92 | 5.94 | 5.84 | 5.57 | 5.58 | 5.46 | 5.74 | 5.70 | 5.37 | 5.14 | 5.05 | 5.07 |

| Colombia | 4.31 | 4.30 | 4.41 | 6.29 | 6.24 | 6.37 | 5.73 | 5.74 | 5.59 | 5.12 | 5.11 | 5.11 | 5.76 | 5.78 | 5.53 | 5.55 | 5.50 | 5.06 |

| Mexico | 4.86 | 4.86 | 4.84 | 6.27 | 6.27 | 6.36 | 5.50 | 5.52 | 5.38 | 5.20 | 5.20 | 5.00 | 5.77 | 5.75 | 5.42 | 5.72 | 5.85 | 5.51 |

| Russia | 5.16 | 5.13 | 5.02 | 5.48 | 5.37 | 5.56 | 5.59 | 5.58 | 5.09 | 5.02 | 5.05 | 4.98 | 5.68 | 5.68 | 5.28 | 4.73 | 4.87 | 5.41 |

| South Africa | 5.70 | 5.70 | 5.74 | 7.36 | 7.40 | 7.99 | 4.58 | 4.65 | 4.74 | 4.93 | 4.92 | 4.92 | 5.60 | 5.60 | 5.29 | 5.87 | 5.89 | 5.84 |

| Thailand | 5.55 | 5.54 | 5.38 | 7.08 | 7.05 | 6.72 | 5.40 | 5.44 | 5.16 | 5.23 | 5.23 | 5.00 | 6.07 | 6.06 | 5.56 | 6.10 | 5.99 | 5.73 |

SOURCE: EBRD.

NOTE: Scores are on a scale of 1 to 10, where 10 represents a synthetic frontier corresponding to the standards of a sustainable market economy. All scores have been updated following methodological changes, so they may differ from those published in previous years’ reports. Owing to lags in the availability of underlying data, ATQ scores for 2024 and 2023 may not fully correspond to developments in those calendar years.

Source: EBRD.

Note: Scores are on a scale of 1 to 10, where 10 represents a synthetic frontier corresponding to the standards of a sustainable market economy.

Source: EBRD, IMF and authors’ calculations.

Note: ATQ scores are simple averages of the scores for the six qualities. The horizontal axis shows GDP per capita in 2023 at market exchange rates.

Source: EBRD and authors’ calculations.

Note: Figures are simple averages of the 2024 scores for the economies in the relevant grouping.

Source: World Bank, IMF and authors’ calculations.

Note: The horizontal axis shows GDP per capita in 2023 at market exchange rates.

Source: International Telecommunication Union, IMF and authors’ calculations.

Note: The horizontal axis shows GDP per capita in 2023 at market exchange rates.

Source: WEF, IMF and authors’ calculations.

Note: The horizontal axis shows GDP per capita in 2023 at market exchange rates.

Source: International Labour Organization (ILO), IMF and authors’ calculations.

Note: The horizontal axis shows GDP per capita in 2023 at market exchange rates.

Source: ILO, IMF and authors’ calculations.

Note: The horizontal axis shows GDP per capita in 2023 at market exchange rates. The vertical axis shows the ratio of the female labour force participation rate to the male labour force participation rate, with higher values denoting a smaller gender gap.

Trends in ATQ scores since 2016

In the period since 2016 – the year that ATQ scores were first published – the largest overall improvements in the EBRD regions have been seen in the areas of integration and the green economy, with the smallest amounts of progress being observed in the areas of competitiveness, inclusion and governance (see Chart 5.9).

Remaining gaps relative to advanced economies

Advanced economies have, if anything, gone backwards since 2016 in the area of governance (see Chart 5.9). However, the governance gap between the EBRD regions and advanced economies remains large (and is larger than those observed for the other five qualities of a sustainable market economy using the ATQ metric). This is consistent with the findings set out in the Transition Report 2019-20, which highlighted the persistent governance deficit in the EBRD regions relative to economies’ levels of economic development.2

Source: EBRD and authors’ calculations.

Note: Figures are simple averages of the scores for the economies in the relevant grouping.

Trends in SSA economies since 2016

In the period since 2016, SSA economies have made the most progress in the areas of resilience and competitiveness (see Chart 5.9). Improvements in competitiveness reflect increases in labour productivity, growth in exports of ICT and financial services as a percentage of GDP, increases in the number of new firms and a decline in subsidies as a percentage of GDP. Higher resilience scores, meanwhile, reflect improved liquidity ratios in the region’s banking systems, lower non-performing loan (NPL) ratios and lower levels of loan dollarisation. At the same time, however, those improvements to SSA economies’ ATQ scores are modest as a percentage of the remaining gap relative to advanced economies or the EBRD regions.

Changes to scores since last year

Changes to scores since last year’s Transition Report reflect (i) recent developments in the economies in question, (ii) a number of methodological changes (such as the fact that exports of advanced business services are now expressed as a percentage of GDP, rather than as a percentage of total exports of services, in order to measure their contribution to economic activity more accurately) and (iii) changes to historical data series (such as the updating of data on greenhouse gas emissions, which are now sourced from the World Resources Institute and were previously sourced from the International Energy Agency). Where changes have been made to the methodology or historical data, all scores for earlier years have also been updated.

References

A. Carruthers and A. Plekhanov (2023)

“Attitudes, beliefs and reforms: Measurement and stylized facts”, EBRD Working Paper No. 283.

EBRD (2019)

Transition Report 2019-20 – Better Governance, Better Economies, London.

EBRD (2024)

Life in Transition IV – Household resilience in a turbulent world, London.

Methodological notes

Transition indicators: six qualities of a sustainable market economy

The transition indicators reflect the judgement of the EBRD’s Office of the Chief Economist, the Impact and Partnerships department, and the Policy Strategy and Delivery department on the transition progress in the economies where the EBRD invests. According to this approach, a sustainable market economy is characterised by six qualities: competitive, well governed, green, inclusive, resilient and integrated.

This approach measures the state of each quality and its components in a given economy, as compared with the other economies in the EBRD regions and a few select developed economies,1 against a frontier. The frontier is set either by the best performance in this group of economies or by an unobserved theoretical value, and provides a common benchmark against which all economies are assessed consistently and comparably. The same frontier values are also applied across the years to ensure that computed scores are comparable and capture changes in underlying indicators through time.

Assessment of transition qualities (ATQ) scores are composite indices combining information from a large number of indicators and assessments in a consistent manner. The underlying indicators within each ATQ score are constructed using a wide range of sources, including national and industry statistics, data from other international organisations and affiliated databases (the World Bank, the International Monetary Fund [IMF], the United Nations); surveys (the Business Environment and Enterprise Performance Survey (BEEPS); the Life in Transition Survey (LiTS) and assessments prepared internally by EBRD experts (see Table M.1 below for the list of indicators).

The computation of ATQ indices involves multiple steps, namely: data preparation, normalisation and aggregation. Details of each of these steps are provided below.

Data preparation and treatment of missing observations

The underlying data for the majority of indicators either enter the composite index directly or are scaled using a meaningful related measure. A number of indicators may themselves be composite indices (for example, the EBRD SME index or EBRD Knowledge Economy index) and they enter the ATQ composites in index form. No further transformation is applied to the underlying indicators before normalisation. For some indicators, no data are available for the current year and simple imputation methods are used.2 One method of imputation uses the latest available observation from past years, thus assuming that no change from the latest available observation has been observed. When there are no past or present observations available for a particular indicator, then, based on the judgement of EBRD experts, either the regional mean (using the EBRD classification of regions for the economies where it invests) or the observed regional minima are used to impute the missing observations.

To mitigate the effect that extreme values may have on scores, observations that lie above the 98th percentile are considered outliers and replaced by the next value within the acceptable range. Outlier detection and replacement is only applied to select continuous variables.

Normalisation

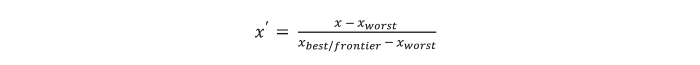

The raw data for each indicator are normalised to the same scale using the min-max normalisation method as follows:

The resulting scores are then rescaled from 1 to 10, where 10 represents the frontier for each quality. The frontier is taken to be the best performance, observed either in an economy where we invest, a comparator economy or a theoretical value determined based on expert judgement.

If an observation for an economy exceeds the selected frontier, then the normalised value of the indicator is capped at the frontier value. For indicators where any deviation from the frontier is undesirable, values either below or above the frontier are treated similarly (the same score is computed and assigned to two observations that are equally distant from the frontier).

Aggregation

Normalised indicators are aggregated to a single composite index (by quality) using weights determined by expert judgement (see Table M.1 for details of weights). A simple weighted averaging method is used for aggregation.

Changes to methodology from 2023

During the past year, further work on strengthening the methodology for computing ATQ indices was carried out. This work did not involve changes to the process of computation of ATQ indices, rather it focused largely on modifications to the set of underlying indicators. The primary purpose of this work has been to ensure that ATQs better capture the relevant phenomena and allow adequate monitoring of the pace of reforms and transformation in the region. This work resulted in the addition of new indicators, a discontinuation of the use of others, and the use of equivalent data series from alternative sources. Details of these changes are provided below.

Overall

The sample of economies used to calculate ATQs was expanded to include six sub-Saharan African economies, namely: Benin, Cote d’Ivoire, Ghana, Kenya, Nigeria and Senegal.

Competitive

The services export indicator, previously measured as a percentage of total services exports, is now measured as a percentage of GDP.

Green

Mitigation indicators, measuring greenhouse gas (GHG) emissions for various sectors, previously sourced from the International Energy Agency are now sourced from the World Resource Institute.

The following tables show, for each quality, the components used in each quality index along with the indicators and data sources that were fed into the final assessments.

| COMPETITIVE | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| Market structures [50%] | Applied tariff rates a (weighted average) [14%] | World Bank, World Development Indicators (WDI), International Trade Centre, Market Access Map, 2021 | Georgia | 2 | 15.9 | |

| Subsidies expense a (share of GDP) [14%] | IMF, government finance statistics, 2021 | Albania | 0.12 | 7.05 | ||

| Resolving insolvency score [14%] | EBRD assessment, 2022 | United States of America | 88.38 | 38.33 | ||

| Number of new business entries (scaled by population) [14%] | World Bank, WDI, 2022 | Estonia* | 18.62 | 0.04 | ||

| SME index adjusted (1 = worst, 10 = best) [14%] | EBRD assessment, 2019 | United Kingdom | 7.73 | 3.52 | ||

| Competition Law, Institutions and Enforcement index adjusted (1 = worst, 10 = best) [14%] | EBRD assessment, 2019 | United Kingdom | 8.02 | 4.89 | ||

| Business services exports (percentage of GDP) [14%] | World Bank, WDI, 2022 | Cyprus | 0.05 | 0 | ||

| Capacity to generate value added [50%] | Economic Complexity Index [14%] | Harvard, Centre for International Development, 2020 | Japan | 2.26 | -1.84 | |

| Knowledge economy index (KEI) adjusted (1 = worst, 10 = best) [14%] | EBRD assessment, 2019 | Sweden | 8.02 | 1.92 | ||

| World Bank Logistics Performance Index (1 = worst, 5 = best) [14%] | World Bank, WDI, 2022 | Germany | 4.10 | 2.06 | ||

| Skills [14%] | World Economic Forum (WEF) Global Competitiveness Index, 2019 | Germany | 84.18 | 42.90 | ||

| Labour productivity (output per worker, GDP in constant 2011 int. US$ PPP) [14%] | ILOSTAT, WDI, 2023 | United States | 110,498.84 | 7,818.28 | ||

| Credit to private sector b (percentage of GDP) [14%] | World Bank, WDI, 2023 | Canada* | 193.49 | 8.58 | ||

| Global value chain participation [14%] | UNCTAD, EBRD, 2018 | Slovak Republic | 0.81 | 0.31 | ||

| WELL GOVERNED | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| National level governance [75%] | Quality of public governance [53%] | Regulatory quality (-2.5 = worst, 2.5 = best) [13%] | World Bank Governance Indicators, 2020 | Germany | 1.75 | -2.30 |

| Government effectiveness (-2.5 = worst, 2.5 = best) [13%] | World Bank Governance Indicators, 2020 | Canada | 1.66 | -1.86 | ||

| Budget transparency (1 = worst, 7 = best) [6%] | WEF Global Competitiveness Index, 2019 | No economy was at the frontier in 2023 | 89.00 | 3.00 | ||

| Private property protection (1 = worst, 7 = best) [6%] | WEF Global Competitiveness Index, 2019 | Japan* | 6.17 | 2.87 | ||

| Intellectual property protection (1 = worst, 7 = best) [6%] | WEF Global Competitiveness Index, 2019 | Japan* | 5.98 | 2.91 | ||

| Burden of government regulation (1 = worst, 7 = best) [13%] | WEF Global Competitiveness Index, 2019 | Azerbaijan* | 4.81 | 1.59 | ||

| Political instability a [4%] | World Bank/EBRD BEEPS, 2018-20 | Montenegro* | 0.01 | 0.96 | ||

| Political stability and absence of violence and terrorism (-2.5 = worst, 2.5 = best) [4%] | World Bank Governance Indicators, 2020 | Canada | 1.02 | -2.61 | ||

| Political and operational stability [4%] | Global Innovation Index, 2019 | Sweden* | 89.1 | 14.90 | ||

| Government ensuring policy stability (1 = worst, 7 = best) [6%] | WEF Global Competitiveness Index, 2019 | Azerbaijan | 5.41 | 1.83 | ||

| World press freedom index a (100 = least free, 0 = most free) [13%] | Reporters Without Borders, 2024 | Sweden* | 87.73 | 8.82 | ||

| E-government participation [7%] | WEF Global Competitiveness Index, 2019 | Japan* | 0.99 | 0.0 | ||

| Online services index [7%] | UNDESA, 2022 | Estonia* | 0.98 | 0.09 | ||

| Integrity and control of corruption [20%] | Corruption Perception index (0 = highly corrupt, 100 = not corrupt) [43%] | Transparency International, 2024 | Sweden* | 82.00 | 19.00 | |

| Perception of corruption a [14%] | World Bank/EBRD BEEPS, 2018-20 | Sweden* | 2.68 | 77.91 | ||

| Informality a [14%] | World Bank/EBRD BEEPS, 2018-20 | Sweden | 0.00 | 63.38 | ||

| Implementation of anti-money laundering (AML)/combating the financing of terrorism (CFT) and tax exchange standards a (0 = low risk, 10 = high risk) [29%] | International Centre for Asset Recovery, 2023 | Estonia* | 3.12 | 8.30 | ||

| Rule of law [27%] | Judicial independence (1 = worst, 7 = best) [22%] | WEF Global Competitiveness Index, 2019 | Japan | 6.19 | 1.99 | |

| Efficiency of legal framework in settling disputes (1 = worst, 7 = best) [22%] | WEF Global Competitiveness Index, 2019 | Sweden* | 5.35 | 1.86 | ||

| Efficiency of legal framework in challenging regulations (1 = worst, 7 = best) [22%] | WEF Global Competitiveness Index, 2019 | Germany* | 5.04 | 1.79 | ||

| Rule of law (-2.5 = worst, 2.5 = best) [22%] | World Bank Governance Indicators, 2020 | Sweden* | 1.69 | -1.88 | ||

| Effectiveness of courts a [11%] | World Bank/EBRD BEEPS, 2018-20 | Montenegro | 0.60 | 45.40 | ||

| Corporate level governance [25%] | Corporate governance frameworks and practices [100%] | Structure and functioning of the board [20%] | EBRD Legal Transition Team (LTT) Corporate Governance Assessment, 2019-2022 | Serbia* | 3.55 | 1.34 |

| Transparency and disclosure [10%] | EBRD LTT Corporate Governance Assessment, 2019.2022 | Lithuania* | 4.7 | 1.41 | ||

| Internal control [20%] | EBRD LTT Corporate Governance Assessment, 2019-2022 | Lithuania* | 4.03 | 1.33 | ||

| Rights of shareholders [20%] | EBRD LTT Corporate Governance Assessment, 2019-2022 | Latvia* | 4.15 | 1.99 | ||

| Stakeholders and institutions [20%] | EBRD LTT Corporate Governance Assessment, 2019-2022 | Estonia* | 4.07 | 0.98 | ||

| Strength of auditing and reporting standards (1 = worst, 7 = best) [10%] | WEF Global Competitiveness Index, 2019 | Canada* | 5.97 | 3.08 | ||

| GREEN | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| Mitigation [35%] | Physical indicators [37%] | Electricity production from renewable sources, including hydroelectric (percentage of total) [17%] | World Bank, World Resources Institute (WRI), 2023 | Albania* | 94.59 | 0.03 |

| Value added from industry (construction, manufacturing, mining, electricity, water and gas) per unit of CO2 emissions from industry (GVA (US$)/total CO2) [17%] | World Bank, WRI, 2021 | Estonia* | 24,648.61 | 573.2 | ||

| MWh consumed per tonne of CO2 emitted from electricity and heat generation (MWh/total CO2) [17%] | World Bank, WRI, 2021 | Albania* | 24.45 | 0.46 | ||

| GDP per tonne of CO2 emitted from residential buildings (from fuel combustion) (GDP(US$)/total CO2) [17%] | World Bank, WRI, 2020 | Sweden | 82,448.77 | 1,314.96 | ||

| Number of registered vehicles per tonne of CO2 emitted from transport [17%] | World Health Organization, WRI, 2016 | Turkmenistan* | 6.88 | 0.01 | ||

| Agricultural sector GVA per tonne of GHG emissions from agriculture (GVA (US$) / total CO2eq) [17%] | World Bank, Food and Agriculture Organization of the United Nations (FAO), 2021 | Japan | 2,516.34 | 43.02 | ||

| Structural indicators [63%] | Market support mechanism for renewable energy production (0 = no support, 0.5 = regulatory support, 1 = revenue support) [20%] | IEA, 2022 | Canada* | 1.00 | 0.00 | |

| INDC rating (0 for no INDC. 0.5 for INDC but not ratified. 1 for ratified INDC) [20%] | World Resources Institute (WRI), CAIT, 2022 | Canada* | 1.00 | 0.00 | ||

| Carbon price (0 = worst, 1 = best) [20%] | World Bank, 2021 | France* | 1.00 | 0.00 | ||

| Fossil fuel subsidies (percentage of GDP) a [20%] | IMF, 2022 | No economy was at the frontier in 2024 | -0.01 | -58.49 | ||

| Just Transition Plan [20%] | EBRD assessment, 2021 | Germany | 1.00 | 0.00 | ||

| Adaptation [30%] | Physical indicators [45%] | NDGAIN human habitat score a [25%] | Notre Dame Global Adaptation Initiative, 2020 | Germany* | -0.37 | -0.63 |

| Aqueduct water stress index a [25%] | WRI, 2023 | No economy was at the frontier in 2024 | 0.00 | -4.82 | ||

| NDGAIN projected change in cereal yield a [25%] | Notre Dame Global Adaptation Initiative, 2020 | Turkmenistan* | 0.13 | -0.98 | ||

| Number of people affected by droughts, extreme temperatures, floods and wildfires in the last 10 years a (per 100,000 people ) [25%] | EM-DAT database, 2022 | Jordan | 6.42 | 866,271.76 | ||

| Structural indicators [55%] | NDGAIN agricultural capacity a [20%] | Notre Dame Global Adaptation Initiative, 2020 | Uzbekistan* | 0.13 | 0.99 | |

| World Governance Indicators: Institutional Quality ( -2.5 = worst, 2.5 = best) [40%] | World Bank, World Governance Indicators, 2020 | Sweden* | 1.69 | -1.88 | ||

| Adaptation in INDCs (1 = there is a national adaptation plan, 0.5 = adaption is mentioned in INDCs, 0 = none of the above) [40%] | CGSpace, CGIAR, 2022 | Czechia* | 1.00 | 0.00 | ||

| Other environmental areas [30%] | Physical indicators [37%] | Population weighted mean annual exposure to PM2.5 a [22%] | Organisation for Economic Co-operation and Development (OECD), 2019 | Estonia* | 5.95 | 88.21 |

| Waste intensive consumption (kg municipal solid waste/US$ household expenditure) a [22%] | Waste Atlas, 2015 | Japan | 0.01 | 0.33 | ||

| Waste generation per capita (kg/cap) a [22%] | Waste Atlas, 2015 | Armenia | 149.70 | 777.00 | ||

| Number of animal (terrestrial and marine) species threatened as proportion of total number assessed a [17%] | IUNC Red list, 2020 | Estonia* | 0.04 | 0.18 | ||

| Number of plant (terrestrial and marine) species threatened normalised by total number assessed a [17%] | IUNC Red list, 2020 | Mongolia | 0.00 | 0.27 | ||

| Structural indicators [63%] | Vehicle emission standards (0 = worst, 6 = best) [34%] | UN Environment Programme, 2021 | Bulgaria* | 6.00 | 0.00 | |

| Municipal solid waste collected (percentage of total generated) [34%] | Waste Atlas, 2015 | Czechia* | 100.00 | 20.00 | ||

| Proportion of terrestrial protected area (percentage of total area) [16%] | World Bank, 2022 | Bulgaria | 40.36 | 0.13 | ||

| Proportion of marine protected areas (percentage of total area) [16%] | World Bank, 2022 | No economy was at the frontier in 2024 | 213.43 | 0.00 | ||

| Cross-cutting [5%] | Number of environmental technology patents (per cent of GDP (billion US$)) [100%] | OECD, 2017 | Japan | 0.97 | 0.00 | |

| INCLUSIVE | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| Human capital development [33%] | Labour force participation rate (% of population aged 15+) [11%] | ILOSTAT, modelled estimates, 2024 | No economy was at the frontier in 2024 | 74.41 | 38.67 | |

| Labour force participation rate (gap women/men) [11%] | ILOSTAT, modelled estimates, 2024 | Turkmenistan | 1.07 | 0.15 | ||

| Output per worker (GDP constant 2017 international $ in PPP) [11%] | ILOSTAT, 2023 | United States | 132,347.32 | 7,818.28 | ||

| Youth not in education, employment or training (% of youth population) a [11%] | ILOSTAT, 2023 | Japan | 2.97 | 38.6 | ||

| Human Capital Index [11%] | World Bank, WDI, 2022 | Japan | 0.84 | 0.3 | ||

| Firms offering formal training to employees (% firms) [11%] | World Bank, WDI, 2019 | No economy was at the frontier in 2024 | 70.30 | 3.40 | ||

| Individuals with standard ICT skills (% of population aged 15+) [11%] | International Telecommunications Union (ITU), 2020 | No economy was at the frontier in 2024 | 47.17 | 2.85 | ||

| Workers employed in occupations at risk of automating (%) a [11%] | OECD, EBRD calculations, 2019 | Jordan | 0.38 | 0.53 | ||

| Workers employed in carbon-intensive sectors (%) a [11%] | Bruegel, EBRD calculations, 2019 | Georgia | 0.03 | 0.14 | ||

| Access to finance and services [33%] | Saving at financial institutions (% of population aged 15+) [14%] | World Bank Financial Inclusion Database (FINDEX), 2021 | Sweden | 80 | 0.12 | |

| Borrowing from financial institutions (% of population aged 15+) [14%] | World Bank FINDEX, 2021 | Canada | 82.83 | 0.84 | ||

| Fixed broadband subscriptions (% of population) [14%] | ITU, 2022 | France | 49.4 | 0.06 | ||

| Cost of a 5GB fixed broadband basket (% GNI per capita) a [14%] | ITU, 2022 | United Kingdom | 2.2 | 39.73 | ||

| Logistics performance index: Quality of trade and transport-related infrastructure [14%] | World Bank, WDI, 2022 | Germany | 4.44 | 1.90 | ||

| Using safely managed drinking water services (% of population) [14%] | World Bank, WDI, 2021 | Hungary | 100.00 | 24.81 | ||

| Using safely managed sanitation services (% population) [14%] | World Bank, WDI, 2021 | Japan | 99.14 | 2.33 | ||

| Policies and norms [33%] | Social benefit spending by the government (% of GDP) [20%] | IMF IFS, 2021 | France | 28.66 | 0.48 | |

| Equal treatment and absence of discrimination [20%] | World Justice Project, 2023 | Japan | 0.84 | 0.34 | ||

| Women, Business and the Law composite score [20%] | WDI, 2022 | Canada* | 100.00 | 26.25 | ||

| Disagreeing that “it is better for everyone involved if the man earns the money and the woman takes care of the home and children” (% population) [20%] | LiTs, 2016 | Canada* | 0.92 | 0.05 | ||

| Women subjected to physical and/or sexual violence in the last 12 months (% female population) a [20%] | WDI, 2016 | Slovenia | 2.00 | 28.80 | ||

| RESILIENT | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| Energy sector resilience [30%] | Liberalisation and market liquidity [50%] | Sector restructuring, corporatisation and unbundling (0 = worst, 0.67 = best) [33%] | EBRD assessment, 2023 | Estonia* | 0.67 | 0.00 |

| Fostering private-sector participation (0 = worst, 0.67 = best) [33%] | EBRD assessment, 2023 | United States* | 0.67 | 0.00 | ||

| Tariff reform (0 = worst, 0.67 = best) [33%] | EBRD assessment, 2023 | Czechia* | 0.67 | 0.00 | ||

| System connectivity [20%] | Domestic connectivity (0 = worst, 0.67 = best) [35%] | EBRD assessment, 2023 | Czechia* | 0.67 | 0.09 | |

| Inter-country connectivity (0 = worst, 0.67 = best) [65%] | EBRD assessment, 2023 | Germany* | 0.67 | 0.00 | ||

| Regulation and legal framework [30%] | Development of an adequate legal framework (0 = worst, 0.67 = best) [50%] | EBRD assessment, 2023 | Czechia* | 0.67 | 0.00 | |

| Establishment of an empowered independent energy regulator (0 = worst, 0.67 = best) [50%] | EBRD assessment, 2023 | Czechia* | 0.67 | 0.00 | ||

| Financial stability [70%] | Banking sector health and intermediation [50%] | Capital adequacy ratio [9%] | IMF Financial Soundness Indicators (FSI), IMF Article IV, IHS Markit, national authorities, Fitch Ratings’ Sovereign Data Comparator, EBRD FI Risk Reports, 2023 | Estonia* | 0.35 | 0.1 |

| Return on assets [9%] | IMF FSI, IMF Article IV, IHS Markit, national authorities, Fitch Ratings’ Sovereign Data Comparator, EBRD FI Risk Reports, 2023 | Türkiye* | 4.86 | -12.47 | ||

| Loan to deposits ratio c [9%] | IMF FSI, IMF Article IV, IHS Markit, national authorities, Fitch Ratings’ Sovereign Data Comparator, EBRD FI Risk Reports, 2023 | Sweden | 2.13 | 0.33 | ||

| Non-performing loans (NPLs) to total gross loans (per cent) a [9%] | IMF FSI, IMF Article IV, IHS Markit, national authorities, Fitch Ratings’ Sovereign Data Comparator, S&P BICRA, EBRD FI Risk Reports, 2023 | Canada* | 0.42 | 54.82 | ||

| Loan loss reserves to NPLs (Provisions to NPLs) b [9%] | IMF FSI, IHS Markit, national authorities, EBRD FI Risk Reports, 2023 | United States* | 100.00 | 15.14 | ||

| Asset share of five largest banks a [9%] | World Bank Global Financial Development Database (GFDD), IMF FSSA, EBRD FI Risk Reports, 2021 | Japan | 43.88 | 100.00 | ||

| Asset share of private banks [9%] | World Bank GFDD, EBRD FI Risk Reports, IMF Article IV, IMF FSSA, Bank Focus, 2021 | Canada* | 100.00 | 33.20 | ||

| Financial sector assets c (percentage of GDP) [9%] | IMF FSI, EBRD, Internal Sovereign Risk Report, Bank Focus, national authorities, IHS Markit, 2023 | No economy was at the frontier in 2024 | 100.00 | 28.00 | ||

| Credit to private sector c (percentage of GDP) [9%] | World Bank GFDD, S&P BICRA, IMF Article IV, WDI, 2023 | No economy was at the frontier in 2024 | 80.00 | 4.02 | ||

| Foreign currency-denominated loans a (percentage of total loans) [9%] | IMF FSI, IMF Article IV, IHS Markit, national authorities, 2023 | United States* | 0.00 | -98.65 | ||

| Liquid assets to short-term liabilities (per cent) [9%] | IMF FSI, World Bank GFDD, IMF Article IV, national authorities, EBRD FI Risk Overview, 2023 | United States* | 241.80 | 15.54 | ||

| Alternative sources of financing [32%] | Other financial corporation’s assets b (percentage of GDP) [14%] | IMF FSI, World Bank GFDD, IMF Article IV, national authorities, EBRD FI Risk Overview, IMF FSSA, AFDB, 2023 | Canada* | 100.00 | 0.0 | |

| Legal environment for financial transactions [14%] | ISDA, ICMA, 2022 | United States* | 2.50 | 0.00 | ||

| Capital market infrastructure [14%] | EBRD assessment, 2022 | United States* | 1.00 | 0.00 | ||

| Investor base [14%] | OECD, IMF, Bloomberg, Swiss RE, WEF, IMF, ECB, S&P (SNL), 2022 | No economy was at the frontier in 2023 | 0.92 | 0.00 | ||

| Market capitalisation b [5%] | WEF, IMF, Bloomberg, local stock exchanges, 2022 | United States* | 100.00 | 0.00 | ||

| Trading to market cap b [5%] | WEF, IMF, Bloomberg, local stock exchanges, 2022 | United States* | 100.00 | 0.00 | ||

| IPO b [5%] | WEF, IMF, Bloomberg, local stock exchanges, 2022 | United States* | 0.34 | 0.00 | ||

| FI debt b [4%] | Cbonds, IMF, 2022 | Germany* | 0.35 | 0.00 | ||

| Non-FI debt b [4%] | Cbonds, IMF, 2022 | United States* | 0.29 | 0.00 | ||

| Debt diversity [7%] | Vanguard Investment, ICMA, 2020 | United States | 6.75 | 0.00 | ||

| Money market quality [14%] | EBRD assessment, 2020 | United States* | 1.00 | 0.00 | ||

| Regulation governance and safety nets [18%] | Is there a well-functioning deposit insurance scheme? (1 = worst, 10 = best) [25%] | EBRD assessment, 2020 | Czechia* | 10.00 | 1.00 | |

| Do the banks have good risk management and corporate governance practices? (1 = worst, 10 = best) [25%] | EBRD assessment, 2020 | Czechia* | 10.00 | 1.00 | ||

| Is there an adequate legal and regulatory framework in place? (1 = worst, 10 = best) [25%] | EBRD assessment, 2020 | Czechia* | 10.00 | 1.00 | ||

| Is the supervisory body independent and competent? (1 = worst, 10 = best) [25%] | EBRD assessment, 2020 | Czechia* | 10.00 | 1.00 | ||

| INTEGRATED | ||||||

|---|---|---|---|---|---|---|

| Components | Sub-components | Indicators | Source | Frontier economy | Frontier value | Worst performance |

| External integration [50%] | Trade openness [33%] | Total trade volume (percentage of GDP, five-year moving average) [50%] | World Bank, WDI, 2023 | Slovak Republic | 185.99 | 25.26 |

| Number of regional trade agreements [17%] | World Trade Organization (WTO), 2023 | Czechia | 47.00 | 1.00 | ||

| Binding overhang ratio a, b (%) [17%] | WTO, 2022 | Germany* | 0.00 | 142.20 | ||

| Number of non-tariff measures a [17%] | WTO, 2022 | Mongolia* | 1 | 46 | ||

| Investment openness [33%] | FDI net inflows (percentage of GDP, five-year moving average) [50%] | IMF, International investment position statistics, 2023 | Cyprus* | 0.89 | -0.35 | |

| Number of bilateral investment agreements [25%] | UNCTAD, 2023 | Germany | 183.00 | 8.00 | ||

| FDI Restrictiveness indicator a [25%] | OECD, 2020 | Slovenia | 0.01 | 0.29 | ||

| Portfolio openness [33%] | Non-FDI inflows (percentage of GDP, five-year moving average) [50%] | IMF, International investment position statistics, 2022 | Cyprus | 0.06 | -0.59 | |

| Financial openness index (Chinn-Ito) [50%] | Chinn-Ito webpage, 2021 | United States* | 2.30 | -1.93 | ||

| Internal integration [50%] | Domestic transport [33%] | Road connectivity a [25%] | EBRD assessment, 2019 | United States | 107.53 | 309.27 |

| Quality of non-road transport infrastructure [25%] | WEF Global Competitiveness Index, 2019 | Japan | 89.92 | 24.25 | ||

| Competence and quality of logistics services (1 = worst, 5 = best) [13%] | World Bank, LPI database, 2022 | Germany | 4.31 | 1.90 | ||

| Tracking and tracing of consignments (1 = worst, 5 = best) [13%] | World Bank, LPI database, 2022 | Sweden | 4.38 | 1.64 | ||

| Timeliness of shipments (1 = worst, 5 = best) [13%] | World Bank, LPI database, 2022 | Germany | 4.45 | 2.04 | ||

| Proportion of products lost to breakage or spoilage during shipping a [13%] | World Bank/EBRD BEEPS, 2018-20 | Estonia* | 0.00 | 2.60 | ||

| Cross-border transport [33%] | Quality of customs and border management, trade and transport infrastructure and ease of arranging shipments (1 = worst, 5 = best) [50%] | World Bank, LPI database, 2022 | Germany | 4.14 | 1.84 | |

| Cost of trading across borders [50%] | ESCAP – World Bank trade cost database, 2020 | Czechia | 107.97 | 392.08 | ||

| Energy and ICT [33%] | Quality of electricity supply (1 = worst, 7 = best) [25%] | WEF Global Competitiveness Index, 2017 | Sweden | 6.78 | 1.65 | |

| Electric power transmission and distribution losses as percentage of domestic supply a [25%] | IEA, 2019 | Slovak Republic | 2.34 | 23.73 | ||

| Broadband subscription (per 100 habitants) [13%] | ITU, 2021 | France | 48.76 | 0.01 | ||

| Number of internet users (percentage of population) [13%] | ITU, 2021 | United States | 96.97 | 14.5 | ||

| Level of competition for internet services (50 = monopoly, 75 = partially competitive, 100 = competitive) [6%] | World Bank, The Little Data Book 2017 | Canada* | 100.00 | 50.00 | ||

| Mobile broadband basket price a [6%] | ITU, 2023 | France | 0.16 | 5.14 | ||

| International internet bandwidth per internet user [6%] | ITU, 2022 | Bulgaria* | 353,000.00 | 41.6 | ||

| 4G coverage (percentage of population) [6%] | ITU, 2022 | Poland* | 100.00 | 75.70 | ||

* Additional economies are at the frontier. Further information is available on request.

a Inverted before normalisation.

b Capped at frontier.

c Mirrored from frontier.