Regional inequality and special economic zones

This chapter examines regional inequalities in EBRD economies and the role played by place-based industrial policies – particularly special economic zones (SEZs) – in reducing those disparities. The analysis shows that SEZs are able to stimulate local economic growth, but their success is heavily influenced by regional factors such as the quality of infrastructure, the availability of human capital and the effectiveness of governance. Predicting the success of individual SEZs is a challenge, which highlights the important roles that local conditions and effective SEZ management play in determining outcomes. A case study looking at technology development zones (TDZs) in Türkiye shows how exactly such zones support the growth and performance of firms.

Introduction

Place-based industrial policies are strategic interventions by governments aimed at promoting economic development and industrial growth in specific geographical areas – particularly those that are economically underdeveloped or underutilised.1 Examples include initiatives fostering the development of industry clusters (such as the biotech cluster in Cambridge, England), which seek to use such clusters to drive innovation, or the establishment of regional development funds (such as the EU’s European Regional Development Fund), which provide financial support to less-developed areas in order to reduce disparities. Governments can also establish SEZs (such as the Shenzhen SEZ in China or the Aegean Free Trade Zone in Izmir), using special regulatory regimes to attract FDI, boost exports, generate employment opportunities and address persistent regional income inequality within their economies.

Persistent regional inequalities

Trends in terms of the evolution of income inequality in the EBRD regions have been mixed (see Chart 3.1, which plots the Gini index – a measure of income inequality where 0 indicates perfect equality and 1 indicates perfect inequality). Between 2000-09 and 2014-22, Bulgaria, Lithuania, Romania and the West Bank and Gaza experienced sizeable increases in income inequality (with their Gini indices rising by at least 0.03 point). Conversely, income inequality declined substantially in Armenia, Georgia, Kazakhstan, Moldova, North Macedonia, Serbia and Tunisia over the same period, with their Gini indices falling by 0.05 point or more.

Source: Companion dataset (28 November 2023 edition) accompanying the UNU-WIDER World Income Inequality Database (WIID) and authors’ calculations.

Note: Data are not available for Azerbaijan, Bosnia and Herzegovina, Lebanon, Turkmenistan or Uzbekistan.

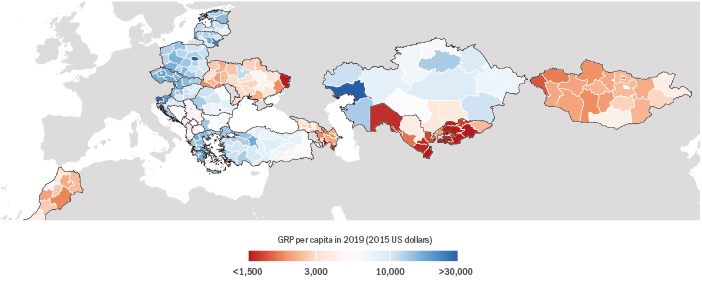

Source: ARDECO database, Wenz et al. (2023), Kazakhstan’s Bureau of National Statistics, GISCO, GADM and authors’ calculations.

Note: This chart shows GRP per capita at the level of NUTS-3 regions for Estonia, Latvia, Lithuania and North Macedonia, at the level of NUTS-2 regions for other EBRD economies in the EU, Albania, Serbia and Türkiye, and at the level of GADM-1 regions for all other EBRD economies except Montenegro. There is a single observation for Montenegro at national level. Data are not available for Armenia, Egypt, Jordan, Kosovo, Lebanon, Moldova, Tunisia, Turkmenistan or the West Bank and Gaza, or for the regions of Abkhazia, Absheron, Crimea or Kalbajar-Lachin.

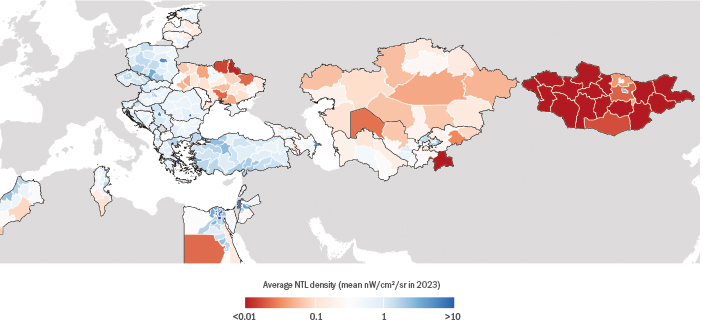

NTL density as a proxy for local economic activity

Given the limited availability of granular data on value added by region, this chapter also uses NTL density as a complementary measure of economic activity. NTL data quantify the average brightness of artificial light emitted at night as captured by satellite imagery and provide a reliable approximation of economic activity, allowing granular spatial analysis of economic disparities. Greater NTL density is, in particular, associated with higher levels of economic activity, urbanisation and development. NTL data are updated frequently and cover remote areas where traditional data collection can be challenging and infrequent.3 At the same time, however, NTL data may overestimate economic activity in densely populated urban areas, while potentially underestimating activity in rural regions,4 and the results of such analysis need to be considered in conjunction with other economic indicators.

Source: Elvidge et al. (2017), VIIRS NTL database, GISCO, GADM and authors’ calculations.

Note: This map shows average NTL density (measured as mean nW/cm /sr) across 1 km x 1 km grid cells within subnational regions in 2023. Data are at the level of NUTS-3 regions for Estonia, Latvia, Lithuania and North Macedonia, at the level of NUTS-2 regions for other EBRD economies in the EU, Albania, Serbia and Türkiye, and at the level of GADM-1 regions for all other EBRD economies except Montenegro. There is a single observation for Montenegro at national level.

Intra-country convergence

Economic convergence occurs when poorer economies (or poorer regions within economies) catch up with richer ones in terms of income levels.8 Analysis of convergence typically distinguishes between beta and sigma convergence. In this chapter, beta convergence measures the extent to which regions with lower initial income levels experience stronger subsequent growth rates and thus catch up with higher-income peers. Beta convergence coefficients are derived from country-specific analysis regressing growth in regional income per capita on the initial level of regional income per capita. Negative values indicate stronger growth in poorer regions, with a value of -0.02 implying that the income gap between regions is narrowing by approximately 2 per cent each year. Conversely, a positive value implies that richer regions are growing faster, and thus the income gap between regions is widening. Sigma convergence, on the other hand, assesses the extent to which the dispersion of the distribution of income levels across regions decreases over time, with negative values indicating a decline in cross-regional inequality (see also Box 3.1).

Source: ARDECO database, Wenz et al. (2023), Kazakhstan’s Bureau of National Statistics, World Bank WDIs and authors’ calculations.

Note: Analysis is based on NUTS-3 regions for EBRD economies in the EU, Albania, North Macedonia, Serbia and Türkiye, and GADM-1 regions for all other EBRD economies. Data for Morocco relate to the period 2013-19; data for all other economies relate to the period 2010-19. Negative rates of beta convergence indicate that poorer regions have grown faster than richer ones (see Box 3.1).

Source: ARDECO database, Wenz et al. (2023), Kazakhstan’s Bureau of National Statistics, World Bank WDIs and authors’ calculations.

Note: Analysis is based on NUTS-3 regions for EBRD economies in the EU, Albania, North Macedonia, Serbia and Türkiye, and GADM-1 regions for all other EBRD economies. Data for Morocco relate to the period 2013-19; data for all other economies relate to the period 2010-19. The intra-country convergence rate measures beta convergence, indicating whether poorer regions within a country have grown faster than richer ones (see Box 3.1).

Persistent urban-rural disparities

Urban-rural disparities offer another important perspective on intra-economy inequality. These can be seen in the fact that individuals born in rural areas are less able to successfully access economic opportunities. Economic research has established the importance of “place effects”, whereby the characteristics of a person’s birthplace and childhood environment can have a long-lasting impact on their future economic prospects.11 The following two-step analysis uses data from the third and fourth rounds of the Life in Transition Survey (LiTS III and LiTS IV) to provide insight into the question of how a person’s place of birth (urban or rural) influences their economic outcomes in adulthood.12 First, in order to isolate the influence of people’s birthplace, the analysis regresses household income percentiles in adulthood on country-year fixed effects capturing circumstances that apply to all residents, as well as individual-specific factors that are predetermined at birth (such as gender and parents’ level of education), and retains the residuals from that regression. Second, a statistical method is used to see how the average remaining variation in household income percentiles differs across birth cohorts, looking separately at individuals born in urban and rural areas. The difference in the remaining unexplained variation for a given birth cohort shows how much higher the income ranking of an urban-born individual is expected to be, relative to an individual born in a rural area in the same year, taking into account other factors (see Box 3.3 for further details of the methodology).

Source: LiTS III, LiTS IV and authors’ calculations.

Note: This chart presents a binned scatter plot of the expected residualised household income percentile (after accounting for predetermined factors; see Box 3.3 for details). The analysis only covers individuals who were born between 1930 and 1990. The dotted lines indicate 95 per cent confidence intervals.

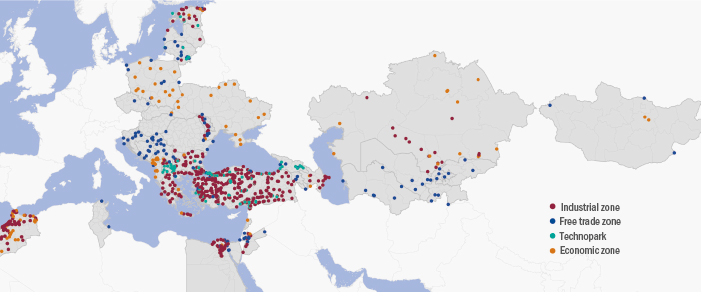

Regional disparities: SEZs to the rescue?

SEZs are often established with a view to addressing regional disparities, mitigating urban-rural divides and promoting economic development in specific regions.14 They often target the cost effective provision of industrial infrastructure in a particular area, seeking to attract international investors. Other SEZs leverage local endowments of natural resources or the potential for innovation. Their legal frameworks often offer benefits such as exemption from customs duties and taxes and simplified regulations. In this respect, SEZs often serve as a starting point for nationwide reforms and help to sustain improvements in investment climates, particularly in economies with weaker governance where it may be easier to establish simplified regulations governing a specific area.

Source: EBRD database of SEZs, GADM 3.6 and authors’ calculations.

Note: This map indicates the locations of various types of SEZ in the EBRD regions.

Source: EBRD database of SEZs and authors’ calculations.

Note: The figure at the top of each bar indicates the total number of SEZs in the relevant economy. There are no SEZs in the Slovak Republic. Separate subzones that are managed by a single body are counted as one SEZ. Zones that span entire regions or countries are not included.

Insights into SEZ rollout strategies and regional characteristics

SEZs can be found in regions with different income levels (see Chart 3.9). While some target lower-income and less-populated areas in order to address regional disparities, others are placed in higher-income regions to leverage existing endowments of human capital or natural resources. For instance, economies such as Poland and Serbia tend to focus largely on lower-income areas with a view to reducing regional disparities, while others (such as Egypt, Kazakhstan and Morocco) put most of their SEZs in more developed regions. In the analysis in this section, “lower-income regions” are defined as areas in the bottom tercile of the distribution of NTL density within the relevant economy, “middle-income regions” fall within the middle tercile and “higher-income regions” are in the top tercile. For each SEZ, NTL density is measured for all areas within a 20 km radius of the centre of the zone in the year prior to its establishment.

SEZs in higher-income regions are generally larger and located in more populous areas closer to urban centres (see Chart 3.10). However, SEZs in all three income categories enjoy similar levels of access to ports, railways and road networks, suggesting consistent infrastructure provision.

Source: EBRD database of SEZs, Li et al. (2020) and authors’ calculations.

Note: This chart indicates the distribution of SEZs across regions in three broad income categories, which are based on the three terciles of the distribution of NTL density. The figure at the top of each bar indicates the number of SEZs that were classified for this purpose in the relevant economy, with some SEZs being omitted owing to a lack of available data. Where an SEZ comprises a number of subzones, the income category selected is the one that corresponds to the largest number of subzones.

Source: EBRD database of SEZs, Li et al. (2020), Schiavina et al. (2023), Wenz et al. (2023), US National Geospatial Intelligence Agency’s Vector Map Level 0 (VMAP0) dataset and World Port Index (2010), Global Roads Open Access Dataset (gROADS), version 1 (produced by Information Technology Outreach Services (ITOS) at University of Georgia), and authors’ calculations.

Note: The proximity index is calculated as the normalised inverse of distance. A proximity of 1 means extremely close and a proximity of 0 means extremely far. The bars show simple average values for the SEZs in each of the three income categories.

Evaluating the impact that SEZs have on local economic development

How successful SEZs have been in promoting local economic development has been a subject of considerable debate. Previous studies of SEZs have largely focused on case studies or produced conflicting results, with no comprehensive cross-country evidence.18 Some studies have found significant positive effects. For example, the establishment of SEZ programmes in China significantly increased foreign investment in target areas without displacing domestic investment, with a positive impact on capital investment, employment, output, productivity, wages, secondary school enrolment rates and the number of firms in designated areas, with new firms driving these effects more than existing ones.19 Other studies point to uncertain outcomes for SEZs, with success dependent on the design of the zone, the local context, the quality of governance and how well the zone is integrated into the broader economy.20

Source: EBRD database of SEZs, Li et al. (2020) and authors’ calculations.

Note: The whiskers indicate 95 per cent confidence intervals.

Source: EBRD database of SEZs, Li et al. (2020) and authors’ calculations.

Note: The whiskers indicate 95 per cent confidence intervals.

What determines the success of SEZs?

This subsection looks at why some SEZs have more success than others, with a zone being deemed to be successful if NTL density within a 5 km radius grows faster over the 10-year period following the establishment of the zone than the average for that economy as a whole. On that basis, roughly 40 per cent of SEZs can be regarded as successful, with the effectiveness of zones varying significantly within a single economy. A horse race regression is used here to assess the relative importance of various variables in explaining the success of SEZs. The analysis uses individual responses to the World Gallup Poll (a representative survey of individuals) over the period 2005-08 to construct measures of institutions and public services at a granular regional level across economies.

Source: EBRD database of SEZs, Li et al. (2020), US National Geospatial-Intelligence Agency’s VMAP0 dataset and World Port Index (2010), ITOS’s gROADS dataset (version 1), Gallup World Polls 2005-08 and authors’ calculations.

Note: An SEZ is regarded as successful if cumulative growth in NTL density within a 5 km radius over a 10-year period is stronger than the average for the economy as a whole over the same period. The community satisfaction index measures satisfaction with public transport, roads and highways, the quality of schools, healthcare and the environment. The access to communications index assesses the availability of high-quality telephone and internet infrastructure, and the law and order index evaluates the level of security. The national institutions index gauges citizens’ confidence in national government, the judicial system and the fairness of elections. The tertiary education index measures the percentage of a subnational region’s population who have a tertiary education. All of these indices are derived from Gallup World Poll data at subnational level. The whiskers indicate 95 per cent confidence intervals.

Source: EBRD database of SEZs, Li et al. (2020), US National Geospatial-Intelligence Agency’s VMAP0 dataset and World Port Index (2010), ITOS’s gROADS dataset (version 1), Gallup World Polls 2005-08 and authors’ calculations.

Note: The factors analysed include infrastructure (distance to a railway, distance to a port, distance to a main road, access to communications and community satisfaction), governance (tertiary education, law and order and national institutions), and country and region fixed effects.

Technology development zones in Türkiye

While the last section analysed the relationship between SEZs and a broad measure of economic activity (NTL density), this section explores the impact that SEZs have on firms’ performance by looking at Türkiye’s TDZs.

Source: Turkish Revenue Administration, TurkStat, Turkish Ministry of Trade, Turkish Firm Registry, Turkish Ministry of Industry and Technology, and authors’ calculations.

Note: Explanatory variables include district, sector-year and firm fixed effects. Investment is calculated as the annual growth rate of total long-term tangible fixed assets (including items such as buildings, land, machinery and other equipment, and vehicles). Exports are measured as the log of (1 + exports in US dollars). Sales growth is calculated as the log difference in total sales between consecutive years. Employment is the log of (1 + number of employees). Total factor productivity is estimated using the Levinsohn-Petrin method and expressed in logs. Profit margins are calculated as the log of (1 + net income/total revenue). “Firm defaults” is a binary variable. The whiskers indicate 95 per cent confidence intervals.

Conclusion and policy implications

The analysis in this chapter highlights the complex dynamics of income inequality and regional disparities within economies in the EBRD regions. Income inequality has declined modestly in the EBRD regions since the 2000s, but urban-rural disparities remain considerable. Although regional income gaps have been slowly narrowing, young urban-born individuals earn considerably more in adulthood than their rural-born counterparts, and this gap has widened substantially for younger cohorts.

Many economies in the EBRD regions use SEZs of different kinds as part of a package of measures aimed at promoting growth and reducing regional disparities. Industrial zones are the most common type of SEZ, particularly in eastern Europe and Türkiye, while free trade zones are popular in Central Asia and eastern Europe. SEZs are frequently found in higher-income regions, where they tend to be larger, closer to urban centres and better integrated into existing infrastructure.

Across the EBRD regions, the establishment of SEZs results in increases in local NTL density in the areas immediately surrounding those zones over a 10-year period. The performance of SEZs varies widely, however, even within a particular economy. Predicting the success of SEZs is challenging, with policy frameworks, institutional quality, local conditions, effective zone management and various other characteristics of zones all playing an important role. In Türkiye, the establishment of TDZs is associated with improvements in the performance of firms located in the relevant regions.

In order to maximise the impact of place-based policies and foster more balanced regional development, policymakers should consider a multidimensional approach. SEZ strategies should be tailored to local contexts, identifying the types of zone and region that have the most potential.25 At the same time, investment in infrastructure – especially transport infrastructure and digital connectivity – should be prioritised. Indeed, proximity to transport networks is an important determinant of the success of SEZs and regional development as a whole.26

The development of human capital is critical in order to enhance the performance of SEZs and underpin a successful transition to higher-value-added economic activities.27 This calls for a focus on expanding educational opportunities and skill development programmes, particularly in tertiary and vocational education. Furthermore, strengthening governance and legal frameworks is also essential, as highlighted by analysis of the determinants of SEZs’ success in this chapter and numerous other studies looking at the crucial role that inclusive institutions play in fostering economic development.28 Lastly, robust monitoring and evaluation systems are essential in order to assess the ongoing impact of SEZs and other place-based policies, allowing timely adjustments to policy designs.29

Box 3.1. Convergence analysis

The analysis of intra-country convergence that is presented in this chapter is based on subnational income data from two sources: the European Commission’s ARDECO database for EBRD economies in the EU, Albania, North Macedonia, Serbia and Türkiye (at the NUTS-3 level), and the DOSE dataset of subnational economic output for all other EBRD economies (at the GADM-1 level).30 Data for the region of West Kazakhstan were sourced from Kazakhstan’s Bureau of National Statistics, since they were not available in the DOSE dataset for the entire period of study. The analysis uses regional data on GRP per capita in constant 2015 US dollars and focuses on the period 2010-19. For Morocco, the period under review is 2013-19 owing to a discontinuity caused by a change to regional administrative boundaries that affects the availability of subnational income data.

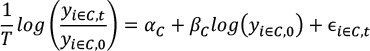

Measures of beta convergence assess whether poorer regions grow faster than richer ones. Estimates are obtained by running the following regression separately for each country:31

where ![]() represents the income level of region

represents the income level of region ![]() in country

in country ![]() at time

at time ![]() ,

, ![]() is the initial income level, and

is the initial income level, and ![]() is the time span between the period

is the time span between the period ![]() and the initial period. The left-hand side approximates the average annual growth rate over the period studied. The speed of convergence is given by the coefficient

and the initial period. The left-hand side approximates the average annual growth rate over the period studied. The speed of convergence is given by the coefficient ![]() which is negative when regions are converging.

which is negative when regions are converging.

Measures of sigma convergence, on the other hand, assess whether income dispersion across subnational regions decreases over time. Estimates of sigma convergence are obtained by comparing the standard deviation of the log of GRP per capita across regions within each country at the start and end of the period:

![]()

Negative values correspond to convergence.

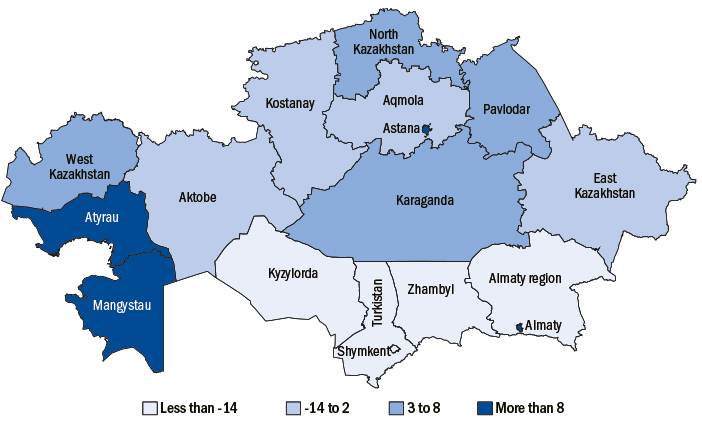

Box 3.2. Competitiveness and regional development traps in Kazakhstan

Since 2000, Kazakhstan has experienced remarkable economic growth, with GDP nearly tripling between 2000 and 2022. This strong performance has been driven by the country’s abundant natural resources and a number of strategic initiatives. While Chart 3.4 shows a significant degree of regional convergence, inequalities continue to persist in Kazakhstan. This box examines those ongoing disparities, drawing on recent research that introduces two new measures: the Regional Competitiveness and Cohesion Index (RCCI) and the Regional Development Trap Index (RDTI).32

Source: Rodríguez-Pose and Bartalucci (2021) and Rodríguez-Pose et al. (2024).

Note: The RCCI measures the economic dynamism and competitiveness of Kazakhstan’s regions, looking at six different aspects: health and a basic standard of living; higher education and training; labour market efficiency; market size; technological readiness; and innovation. This map shows the competitiveness of the various regions on the basis of the four quartiles of the RCCI distribution: dark blue denotes the most competitive quartile (which comprises regions with an RCCI score of more than 8), while light blue denotes the least competitive quartile (which comprises regions with a score of less than -14). The RCCI scores are based on data for 2019, so the map shows Kazakhstan’s regional boundaries as they were at that point in time and does not reflect more recent changes.

Box 3.3. Measuring the urban-rural gap across cohorts

This chapter uses individual-level data from the 2016 and 2022-23 rounds of the Life in Transition Survey (a representative household survey conducted by the EBRD in partnership with the World Bank) to document the income gap between individuals born in urban and rural areas across different birth cohorts. The analysis involves two steps. First, residuals are obtained from the regression:

![]()

where ![]() it is the equivalised household income percentile of individual

it is the equivalised household income percentile of individual ![]() ,

, ![]() is a country-year fixed effect, and

is a country-year fixed effect, and ![]() is a vector of variables that are predetermined at birth (gender and parents’ level of education). Residualising the dependent variable removes the influence that these factors have on income, thereby isolating the effect that urban and rural birthplaces have on income disparities.

is a vector of variables that are predetermined at birth (gender and parents’ level of education). Residualising the dependent variable removes the influence that these factors have on income, thereby isolating the effect that urban and rural birthplaces have on income disparities.

Second, the following function is estimated separately for those born in urban and rural areas:

![]()

where ![]() is the resulting household income percentile residual for individual

is the resulting household income percentile residual for individual ![]() , and

, and ![]() is a flexible, non-parametric function capturing the relationship between individuals’ income rankings and birth cohorts. A binned scatter plot is used, partitioning the range of birth cohorts into bins and estimating the conditional mean of the dependent variable within each bin.

is a flexible, non-parametric function capturing the relationship between individuals’ income rankings and birth cohorts. A binned scatter plot is used, partitioning the range of birth cohorts into bins and estimating the conditional mean of the dependent variable within each bin.

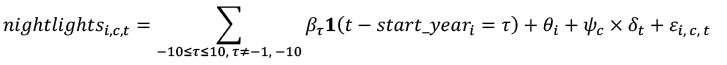

Box 3.4. Evaluating the impact of SEZs on the basis of NTL density

This chapter uses an event study to evaluate the impact that SEZs have on NTL density, which serves as a proxy for economic activity. The empirical strategy used isolates the effect that the establishment of SEZs has on economic activity by comparing NTL density before and after the establishment of zones, while controlling for fixed effects and potential confounding factors. The primary equation used is:

where ![]() denotes the zone,

denotes the zone, ![]() indicates the country and

indicates the country and ![]() represents the calendar year. The “start year” is the year when the zone becomes operational.

represents the calendar year. The “start year” is the year when the zone becomes operational. ![]() represents zone fixed effects, accounting for baseline factor endowment, economic structure and other zone-specific characteristics, and

represents zone fixed effects, accounting for baseline factor endowment, economic structure and other zone-specific characteristics, and ![]() represents country-year fixed effects, capturing country-specific shocks and policies that could influence outcomes for all zones in a given country in a given year. Standard errors are clustered at zone level. The analysis is conducted for the period from 1992 to 2020, which is based on the availability of NTL data.

represents country-year fixed effects, capturing country-specific shocks and policies that could influence outcomes for all zones in a given country in a given year. Standard errors are clustered at zone level. The analysis is conducted for the period from 1992 to 2020, which is based on the availability of NTL data.

Box 3.5. SEZs and pollution

The impact of SEZs extends beyond economic growth. Since they are designed to attract investment through preferential economic regulation and other incentives, SEZs may also have the effect of increasing local pollution. Studies examining the large expansion of SEZs in China reveal that regions with SEZs have, on average, tended to experience lower air quality than other regions.33 However, the magnitude of those effects varies significantly across zones and regions. This box extends that analysis to the EBRD regions.

Source: Van Donkelaar et al. (2021) and authors’ calculations.

Note: This chart shows the effect that establishing an SEZ has on subsequent average PM 2.5 pollution within a 1 km radius of the centre of the zone.

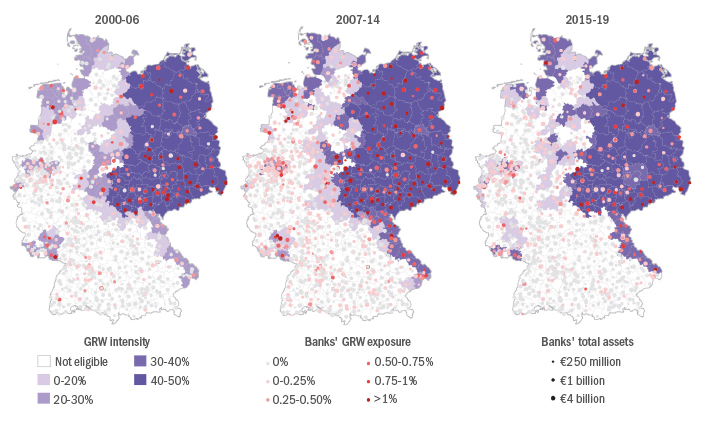

Box 3.6. Place-based industrial policies and credit markets: Evidence from the former East and West Germany

Many place-based industrial policies involve direct transfers to companies, which can be thought of as equity contributions to investment projects. These transfers can affect credit markets in two opposing ways. Subsidies can reduce the cost of capital such that previously unprofitable projects become viable, increasing aggregate investment and potentially leading to more bank lending. However, subsidising projects that would have gone ahead even without those transfers can distort credit markets. Subsidised companies can replace planned borrowing with transfers, reducing their need for bank loans and crowding out bank funding. Moreover, banks that are unwilling or unable to increase total lending may reallocate credit to subsidised firms at the expense of non-subsidised ones.

Source: Kazakov et al. (2022).

Note: This chart shows maps of Germany, with county-level measures of GRW intensity depicted using shades of purple and geo-located banks depicted as circles. GRW intensity is calculated as the maximum share of an eligible firm’s project investment which can be covered by the subsidy and ranges from 0 to 50 per cent. The colour of the circles depicting banks shows the extent of each bank’s exposure to subsidised firms, measured as subsidised firms’ average share of all firms with which the bank maintains links over the relevant period. The size of each circle is proportionate to the logarithm of total bank assets. The sample comprises German savings and cooperative banks.

Source: Kazakov et al. (2022).

Note: This chart shows the impact that the GRW programme has on corporate borrowing and bank lending. These effects are obtained from the estimation of the two equations above. All point estimates are accompanied by 95 per cent confidence intervals. The firm sample comprises German non-financial subsidised firms, each of which is matched to one non-subsidised counterpart, and spans the period from 2002 to 2020. The main variable of interest for that sample is an indicator variable that is equal to 1 in all years after a firm receives its first GRW subsidies (and 0 otherwise). The bank sample comprises German savings and cooperative banks and spans the period from 1998 to 2019. The main variable of interest for that sample is an indicator capturing subsidised firms’ share of a bank’s total customers in a given year.

Box 3.7. Lessons from the EU’s Cohesion Policy

The EU’s Cohesion Policy – the world’s most extensive territorial development initiative – offers valuable insights for policymakers considering regional development strategies. Since 1989, it has invested over €1 trillion with a view to reducing regional disparities and promoting balanced economic growth across the EU. It has influenced similar initiatives in other parts of the world, including place-based industrial policies in the United States and regional development programmes in China. Operating on the basis of a multi-annual financial framework, with the current period running from 2021 to 2027, the policy aims to strengthen economic and social cohesion by reducing disparities between subnational regions and EU member states in terms of development levels.

Box 3.8. Evaluating the impact that TDZs have on firm-level outcomes in Türkiye

This box analyses the impact that Türkiye’s TDZs have on firm-level outcomes, comparing the performance of firms located in districts with TDZs with that of firms in other districts without TDZs. It employs the following regression model:

![]()

where ![]() denotes measures of the performance of firm

denotes measures of the performance of firm ![]() operating in district

operating in district ![]() at time

at time ![]() . Outcome variables include (i) the annual growth rate of total long-term tangible fixed assets (including items such as buildings, land, machinery and other equipment, and vehicles), (ii) the log of 1 plus exports in US dollars, (iii) the log difference in total sales between consecutive years, (iv) the log of 1 plus the number of employees, (v) total factor productivity estimated using the Levinsohn Petrin method and expressed in logs, (vi) profit margins calculated as the log of (1 + net income/total revenue) and (vii) a binary variable for firm defaults.

. Outcome variables include (i) the annual growth rate of total long-term tangible fixed assets (including items such as buildings, land, machinery and other equipment, and vehicles), (ii) the log of 1 plus exports in US dollars, (iii) the log difference in total sales between consecutive years, (iv) the log of 1 plus the number of employees, (v) total factor productivity estimated using the Levinsohn Petrin method and expressed in logs, (vi) profit margins calculated as the log of (1 + net income/total revenue) and (vii) a binary variable for firm defaults. ![]() is a dummy variable indicating the existence (or not) of a

is a dummy variable indicating the existence (or not) of a ![]() in district

in district ![]() at time

at time ![]() . All specifications include district, sector-year and firm fixed effects. District fixed effects account for time-invariant factors at district level. Sector year fixed effects control for confounding factors that vary across sectors and over time. Standard errors are clustered at district level.

. All specifications include district, sector-year and firm fixed effects. District fixed effects account for time-invariant factors at district level. Sector year fixed effects control for confounding factors that vary across sectors and over time. Standard errors are clustered at district level.

The data cover the period 2009-22. Firm location data have been obtained from tax authorities at district level. Financial statements (including annual income statements and balance sheets for all Turkish non-financial firms) have been sourced from the Turkish Revenue Administration and TurkStat, as have employment data detailing the number of employees at each firm. Export data have been obtained from the Turkish Ministry of Trade. Credit registry data, which provide details of credit balances, have been sourced from the Central Bank of the Republic of Türkiye’s Credit Registry. Data on the rollout of TDZs, which detail their locations and dates of establishment, have been sourced from the Ministry of Industry and Technology.

References

D. Acemoğlu and J.A. Robinson (2013)

Why Nations Fail: The Origins of Power, Prosperity and Poverty, Crown Business.

A. Aggarwal (2012)

Social and economic impact of SEZs in India, Oxford University Press.

M. Alkon (2018)

“Do special economic zones induce developmental spillovers? Evidence from India’s states”, World Development, Vol. 107, pp. 396-409.

D. Arkhangelsky, S. Athey, D.A. Hirshberg, G.W. Imbens and S. Wager (2021)

“Synthetic difference-in-differences”, The American Economic Review, Vol. 111, No. 12, pp. 4088 4118.

E. Atalay, A. Hortaçsu, M. Runyun, C. Syverson and M.F. Ulu (2023)

“Micro- and Macroeconomic Impacts of a Place-Based Industrial Policy”, NBER Working Paper No. 31293.

J. Bachtler and G. Gorzelak (2007)

“Reforming EU Cohesion Policy: A reappraisal of the performance of the Structural Funds”, Policy Studies, Vol. 28, No. 4, pp. 309-326.

F. Barca, P. McCann and A. Rodríguez-Pose (2012)

“The case for regional development intervention: place-based versus place-neutral approaches”, Journal of Regional Science, Vol. 52, No. 1, pp. 134-152.

R.J. Barro (2015)

“Convergence and modernisation”, The Economic Journal, Vol. 125, No. 585, pp. 911-942.

R.J. Barro and X. Sala-i-Martin (1992)

“Convergence”, Journal of Political Economy, Vol. 100, No. 2, pp. 223-251.

S.O. Becker, P.H. Egger and M. von Ehrlich (2010)

“Going NUTS: The effect of EU Structural Funds on regional performance”, Journal of Public Economics, Vol. 94, No. 9-10, pp. 578-590.

M. Brachert, E. Dettmann and M. Titze (2018)

“Public Investment Subsidies and Firm Performance – Evidence from Germany”, Jahrbücher für Nationalökonomie und Statistik, Vol. 238, No. 2, pp. 103-124.

T. Chang, J. Graff Zivin, T. Gross and M. Neidell (2016)

“Particulate Pollution and the Productivity of Pear Packers”, American Economic Journal: Economic Policy, Vol. 8, No. 3, pp. 141-169.

K.Y. Chay and M. Greenstone (2003)

“The Impact of Air Pollution on Infant Mortality: Evidence from Geographic Variation in Pollution Shocks Induced by a Recession”, The Quarterly Journal of Economics, Vol. 118, No. 3, pp. 1121-1167.

X. Chen and W.D. Nordhaus (2011)

“Using luminosity data as a proxy for economic statistics”, Proceedings of the National Academy of Sciences, Vol. 108, No. 21, pp. 8589-8594.

E. Chyn and L.F. Katz (2021)

“Neighborhoods Matter: Assessing the Evidence for Place Effects”, The Journal of Economic Perspectives, Vol. 35, No. 4, pp. 197-222.

T. Deryugina, G. Heutel, N.H. Miller, D. Molitor and J. Reif (2019)

“The Mortality and Medical Costs of Air Pollution: Evidence from Changes in Wind Direction”, The American Economic Review, Vol. 109, No. 12, pp. 4178-4219.

G. Duranton and A.J. Venables (2018)

“Place-based policies for development”, World Bank Policy Research Working Paper No. WPS8410.

EBRD (2024)

Life in Transition IV – Household resilience in a turbulent world, London.

C.D. Elvidge, K.E. Baugh, M. Zhizhin, F.-C. Hsu and T. Ghosh (2017)

“VIIRS night-time lights”, International Journal of Remote Sensing, Vol. 38, No. 21, pp. 5860-5879.

C.D. Elvidge, F.-C. Hsu, K.E. Baugh and T. Ghosh (2014)

“National Trends in Satellite-Observed Lighting: 1992-2012”, in Q. Weng (ed.), Global Urban Monitoring and Assessment through Earth Observation, CRC Press, pp. 97-118.

European Commission (2021)

“New Cohesion Policy”, Luxembourg. Available at: https://ec.europa.eu/regional_policy/en/2021_2027 (last accessed on 15 September 2024).

European Commission (2022)

Cohesion in Europe towards 2050 – Eighth report on economic, social and territorial cohesion, Luxembourg.

T. Farole and G. Akinci (2011)

“Special Economic Zones: Progress, Emerging Challenges, and Future Directions”, World Bank.

A.R. Ferrara, P. McCann, G. Pellegrini, D. Stelder and F. Terribile (2017)

“Assessing the impacts of Cohesion Policy on EU regions: A non-parametric analysis on interventions promoting research and innovation and transport accessibility”, Papers in Regional Science, Vol. 96, No. 4, pp. 817-842.

S.A. Frick and A. Rodríguez-Pose (2018)

“Big or small cities? On city size and economic growth”, Growth and Change, Vol. 49, No. 1, pp. 4-32.

S.A. Frick and A. Rodríguez-Pose (2023)

“What draws investment to special economic zones? Lessons from developing countries”, Regional Studies, Vol. 57, No. 11, pp. 2136-2147.

S.A. Frick, A. Rodríguez-Pose and M.D. Wong (2019)

“Toward economically dynamic Special Economic Zones in emerging countries”, Economic Geography, Vol. 95, No. 1, pp. 30-64.

N. Jean, M. Burke, M. Xie, W.M. Davis, D.B. Lobell and S. Ermon (2016)

“Combining satellite imagery and machine learning to predict poverty”, Science, Vol. 353, No. 6301, pp. 790-794.

R. Kanbur and A.J. Venables (eds.) (2005)

Spatial Inequality and Development, Oxford University Press.

A. Kazakov, M. Koetter, M. Titze and L. Tonzer (2022)

“Firm Subsidies, Financial Intermediation, and Bank Risk”, IWH Discussion Paper No. 2/2022.

J. Le Gallo, S. Dall’Erba and R. Guillain (2011)

“The Local Versus Global Dilemma of the Effects of Structural Funds”, Growth and Change, Vol. 42, No. 4, pp. 466-490.

X. Li, Y. Zhou, M. Zhao and X. Zhao (2020)

“A Harmonized Global Nighttime Light Dataset 1992-2018”, Scientific Data, Vol. 7, Article 168.

F. Lu, W. Sun and J. Wu (2023)

“Special economic zones and human capital investment: 30 years of evidence from China”, American Economic Journal: Economic Policy, Vol. 15, No. 3, pp. 35-64.

Y. Lu, J. Wang and L. Zhu (2019)

“Place-based policies, creation, and agglomeration economies: Evidence from China’s economic zone program”, American Economic Journal: Economic Policy, Vol. 11, No. 3, pp. 325-360.

L.A. Martin and K. Zhang (2021)

“Changing population exposure to pollution in China’s Special Economic Zones”, AEA Papers and Proceedings, Vol. 111, pp. 406-409.

C. Mellander, J. Lobo, K. Stolarick and Z. Matheson (2015)

“Night-time light data: A good proxy measure for economic activity?”, PLOS ONE, Vol. 10, No. 10, Article e0139779.

C. Mendez and J. Bachtler (2017)

“Financial Compliance in the European Union: A Cross-National Assessment of Financial Correction Patterns and Causes in Cohesion Policy”, Journal of Common Market Studies, Vol. 55, No. 3, pp. 569 592.

K.H. Midelfart-Knarvik and H.G. Overman (2002)

“Delocation and European integration: is structural spending justified?”, Economic Policy, Vol. 17, No. 35, pp. 321-359.

OECD (2018)

OECD Regions and Cities at a Glance 2018, Paris.

OECD (2019)

Rethinking Innovation for a Sustainable Ocean Economy, Paris.

G. Pellegrini, F. Terribile, O. Tarola, T. Muccigrosso and F. Busillo (2013)

“Measuring the effects of European Regional Policy on economic growth: A regression discontinuity approach”, Papers in Regional Science, Vol. 92, No. 1, pp. 217-234.

A. Rodríguez-Pose and F. Bartalucci (2021)

“Joint Government of Kazakhstan and the Asian Development Bank Knowledge and Experience Exchange Program, Phase 4: Regional Inequality Study for Kazakhstan – Technical Assistance Consultant’s Report”, Asian Development Bank, Project No. 54093-001.

A. Rodríguez-Pose, F. Bartalucci, B. Kurmanov, G. Rau and K. Nigmetov (2024)

“Assessing regional inequalities in Kazakhstan through well-being”, Asian Development Review, Vol. 41, No. 1, pp. 301-333.

A. Rodríguez-Pose and E. Garcilazo (2015)

“Quality of government and the returns of investment: Examining the impact of cohesion expenditure in European regions”, Regional Studies, Vol. 49, No. 8, pp. 1274-1290.

D. Rodrik and S. Stantcheva (2021)

“A Policy Matrix for Inclusive Prosperity”, NBER Working Paper No. 28736.

M. Schiavina, M. Melchiorri and M. Pesaresi (2023)

“GHS-SMOD R2023A – GHS settlement layers, application of the Degree of Urbanisation methodology (stage I) to GHS-POP R2023A and GHS-BUILT-S R2023A, multitemporal (1975-2030)”, European Commission Joint Research Centre.

J. Tosun (2014)

“Absorption of Regional Funds: A Comparative Analysis”, Journal of Common Market Studies, Vol. 52, No. 2, pp. 371-387.

UNCTAD (2019)

World Investment Report 2019 – Special Economic Zones, Geneva.

UN DESA (2024)

World Social Report 2024 – Social Development in Times of Converging Crises: A Call for Global Action, New York.

A. van Donkelaar, M.S. Hammer, L. Bindle, M. Brauer, J.R. Brook, M.J. Garay, N.C. Hsu, O.V. Kalashnikova, R.A. Kahn C. Lee, R.C. Levy, A. Lyapustin, A.M. Sayer and R.V. Martin (2021)

“Monthly Global Estimates of Fine Particulate Matter and Their Uncertainty”, Environmental Science & Technology, Vol. 55, No. 22, pp. 15287-15300.

J. Wang (2013)

“The economic impact of Special Economic Zones: Evidence from Chinese municipalities”, Journal of Development Economics, Vol. 101, pp. 133-147.

L. Wenz, R.D. Carr, N. Kögel, M. Kotz and M. Kalkuhl (2023)

“DOSE – Global data set of reported sub-national economic output”, Scientific Data, Vol. 10, Article 425.

World Bank (2009)

World Development Report 2009: Reshaping Economic Geography, Washington, DC.

World Bank (2017)

Special Economic Zones: An Operational Review of Their Impacts, Washington, DC.

World Bank (2022)

The Global Health Cost of PM 2.5 Air Pollution. A Case for Action Beyond 2021, Washington, DC.

A. Young (2013)

“Inequality, the Urban-Rural Gap, and Migration”, The Quarterly Journal of Economics, Vol. 128, No. 4, pp. 1727-1785.

D.Z. Zeng (2021)

“Special Economic Zones: Lessons from the Global Experience”, PEDL Synthesis Paper No. 1, Centre for Economic Policy Research.